MIDLAND, Texas — Taxes are a reality that we all must deal with. They can also be frustrating, and that might be because it isn’t fully understood how the taxing process works.

We know they impact our bank accounts, but there are many variables that lead to that result. The tax rate deals with property taxes, which all comes down to a valuation of your property’s worth.

Tax rates are like heart rates, but instead of beats per minute, cents per $100.

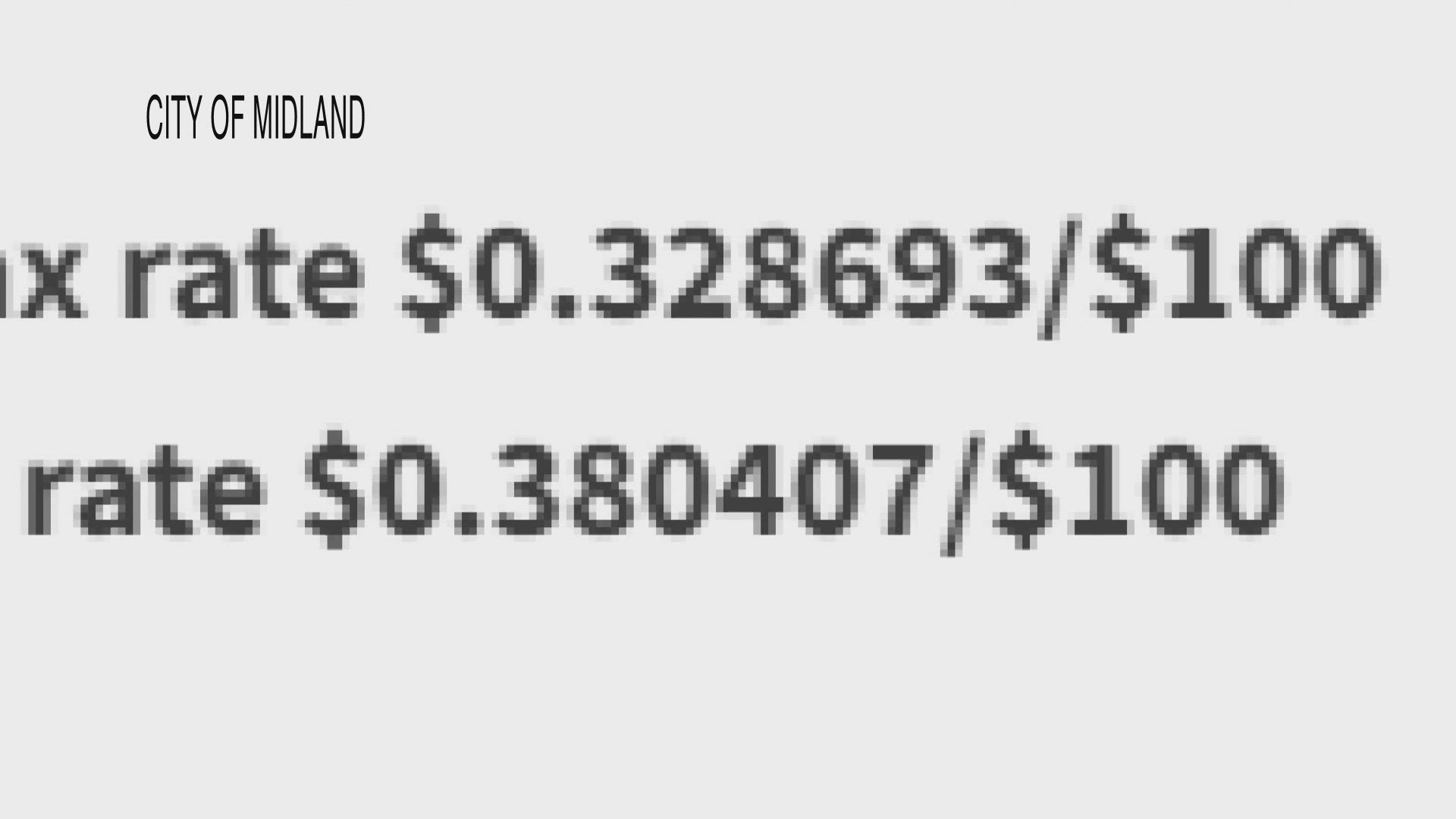

“The property tax rate is a tax rate levied for every $100 worth of valuation of your home," said Christy Weakland, director of finance for the City of Midland.

The State of Texas provides tax rate parameters, while the Midland Central Appraisal District, or MCAD, provides valuations of property.

“The first thing MCAD calculates for us is they tell us a no-new-revenue rate and a voter approval rate," Weakland said. "The no-new-revenue rate is a rate by which we get the same dollars we got last year, so we get no new revenue, and then we’re only allowed to go 3.5% above that rate."

Midland is just one entity that benefits from taxes generated.

“The taxing entities for Midland are the county, the hospital district, Midland College, the city and of course [Midland] ISD. And MCAD then distributes those funds out to those different entities," Weakland said.

Anyone with property within the city limits will pay to those entities.

“MCAD sends the valuations and calculations of the rates to each taxing entity, and then based on certain parameters given by the state, the governing bodies of those entities determine what tax rate will be set," Weakland said.

So while taxes are taxing, it would be healthy to not let them impact your heart rate.

“We try to be as frugal as we can with our budget but also keep up with the maintenance needs of the city, and then the tax rate’s supposed to be set according to the needs of the budget," Weakland said.

Weakland noted that property taxes are one-third of how they can provide services to Midland. She also mentioned that while valuations are going up, the highest the city can raise the tax rate from the no-new-revenue rate will still keep the property tax rate this year lower than last year.