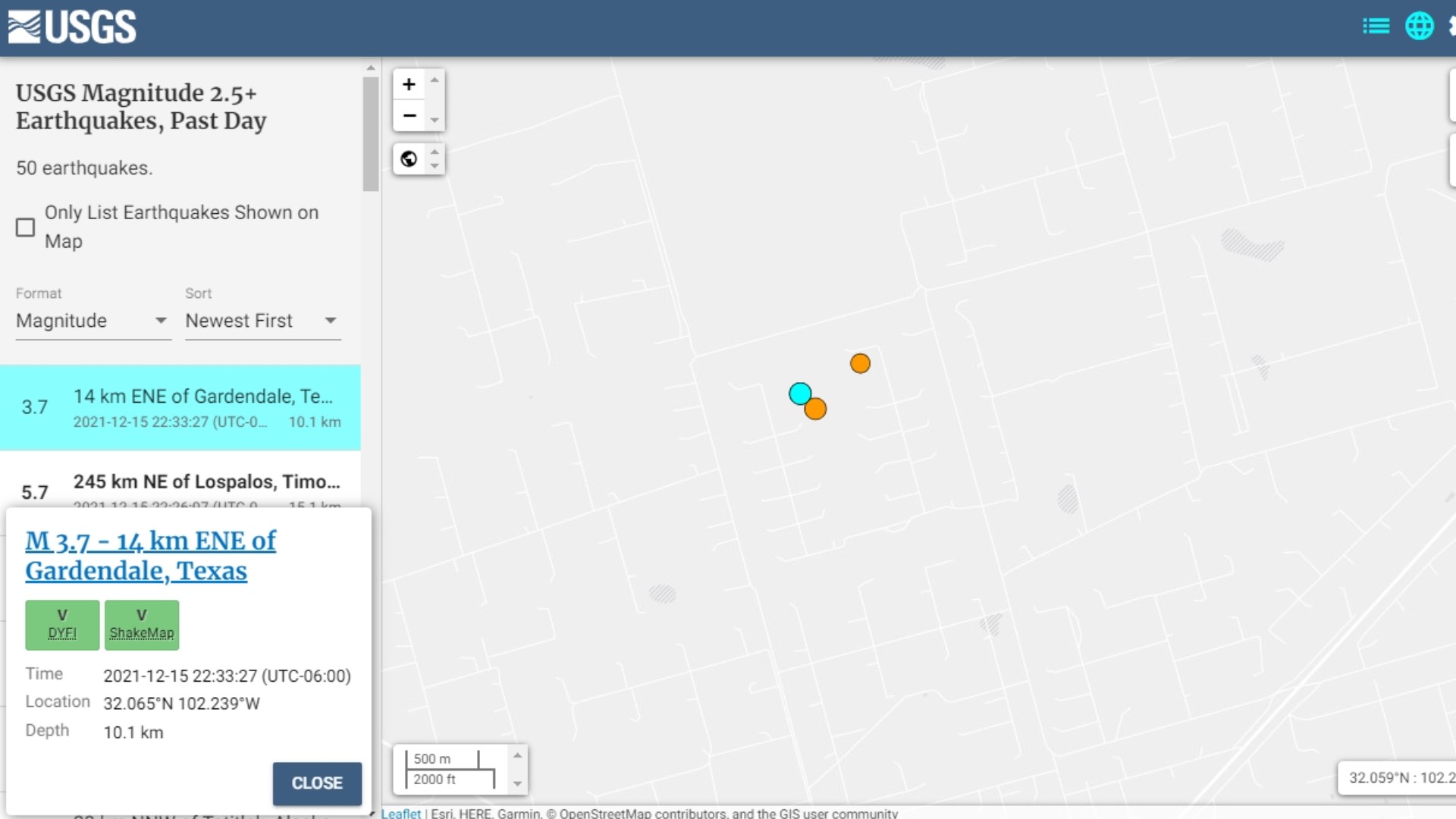

ODESSA, Texas — Over the last couple of days, there have been several earthquakes near the Gardendale area. It's led to people asking whether or not their current insurance protects them from earthquake damage.

Chris Wray, a State Farm agent, said that after small earthquakes hit the Midland-Odessa area, he typically receives calls asking about earthquake protection.

"Usually after an earthquake, we get a handful of inquiries here at our office, you know 10-12 inquiries every time, just wondering if their insurance covers earthquake," Wray said. "Of course, earthquake is not included in the main part of the policy."

While the earthquakes near Gardendale were relatively small, Wray said that the quakes can make people nervous about not being protected against potentially bigger ones.

"Every time it shakes and quakes on us, it makes everybody a little bit nervous," Wray said. "So you know it’s hard to say if anything big will come from it, but number of them that we’re getting, it sure makes you nervous."

For anyone looking at potentially getting extra insurance, the price can vary.

"If you have to buy a policy in and of itself on an average home, I’ve seen a couple of those quotes, and they were about $1,000 a year," Wray said. "You know our endorsement that we put on ours is about $150 a year. That way we just attach it onto the homeowner's policy, but not everybody offers that."

When it comes to earthquakes and insurance, Wray said to know what you have and what it actually covers.

"I think it’s always important to know what your policy covers and doesn’t cover because there are certain exclusions for certain things that just aren’t covered, and you need to know that come claim time so that you’re not disappointed," Wray said.